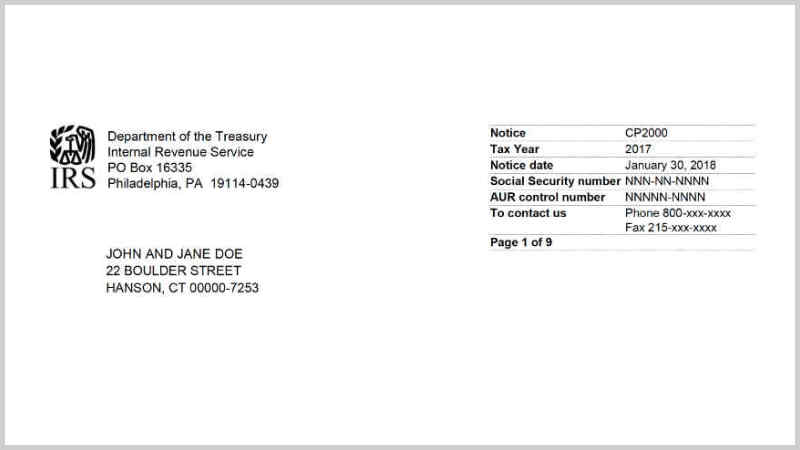

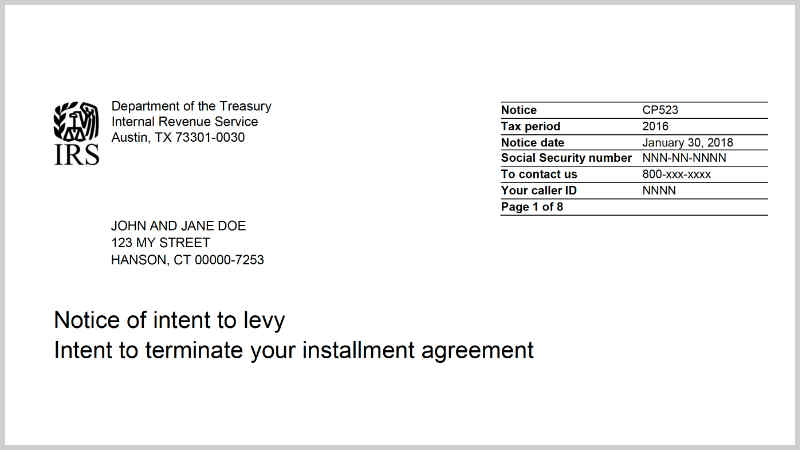

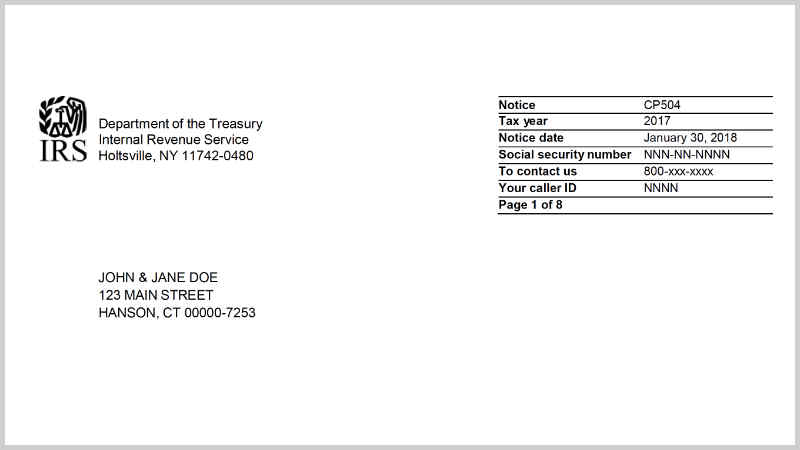

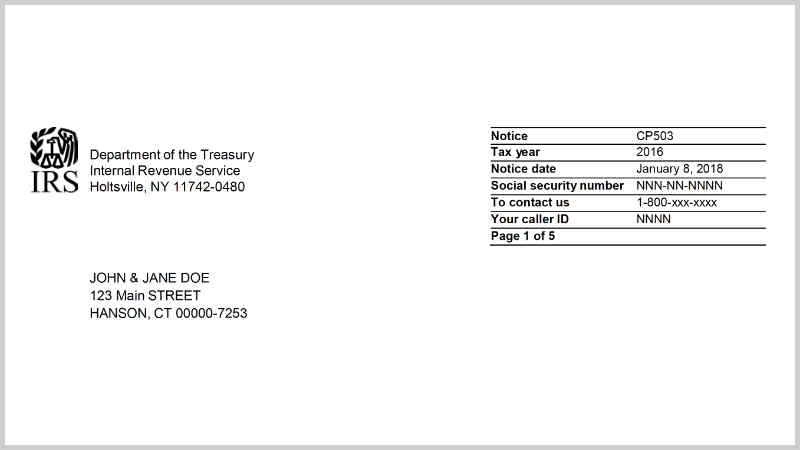

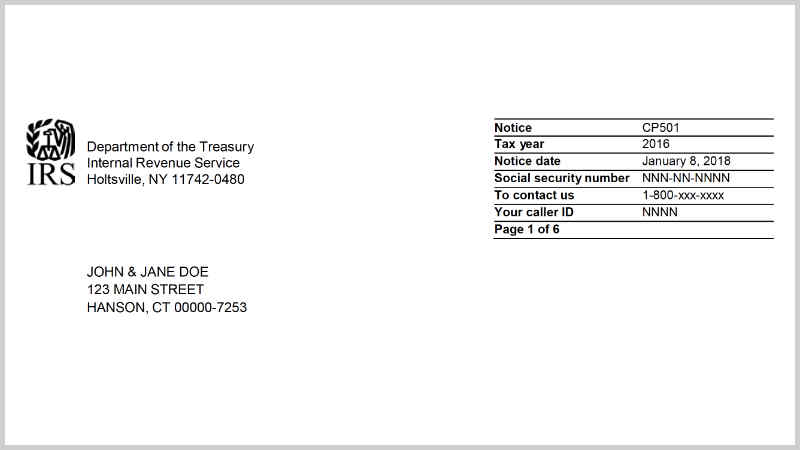

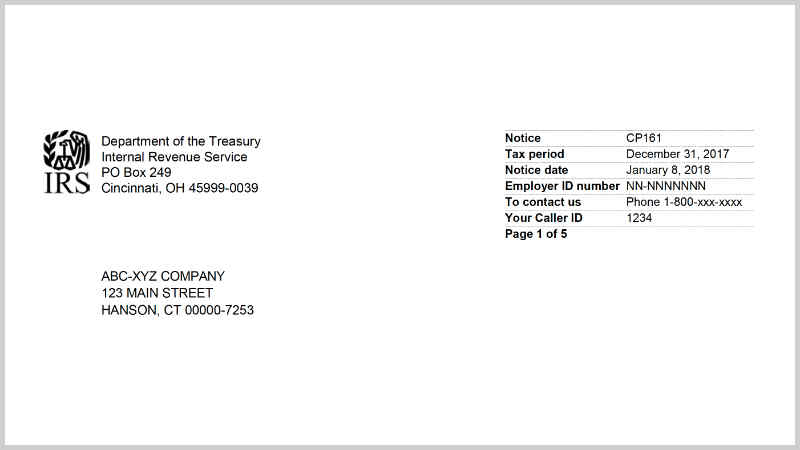

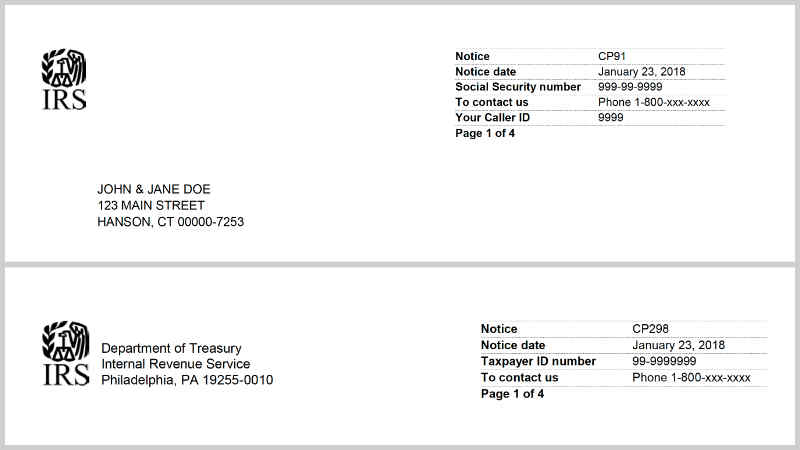

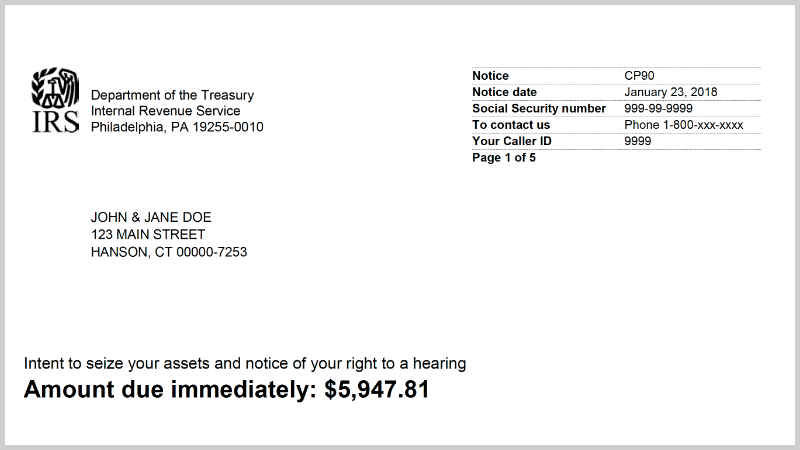

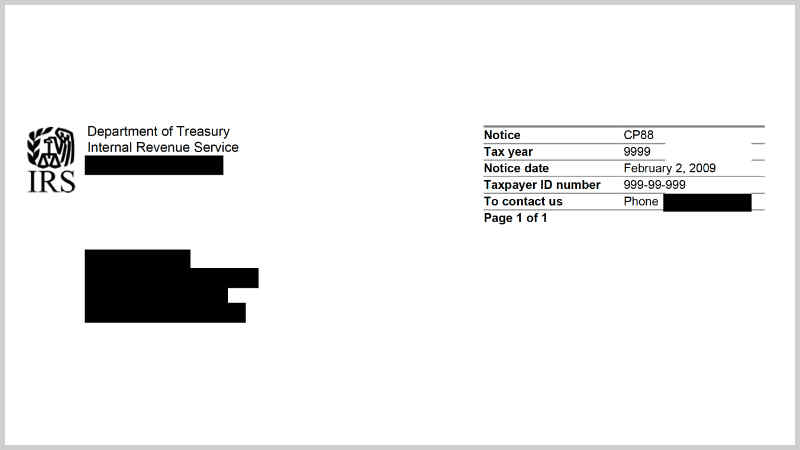

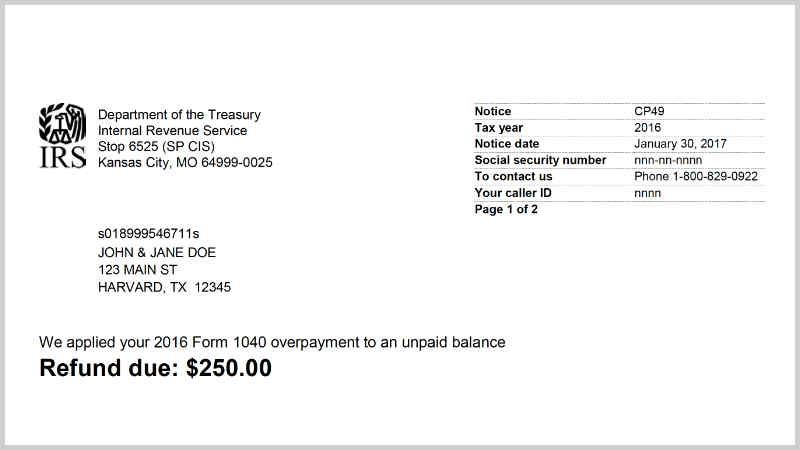

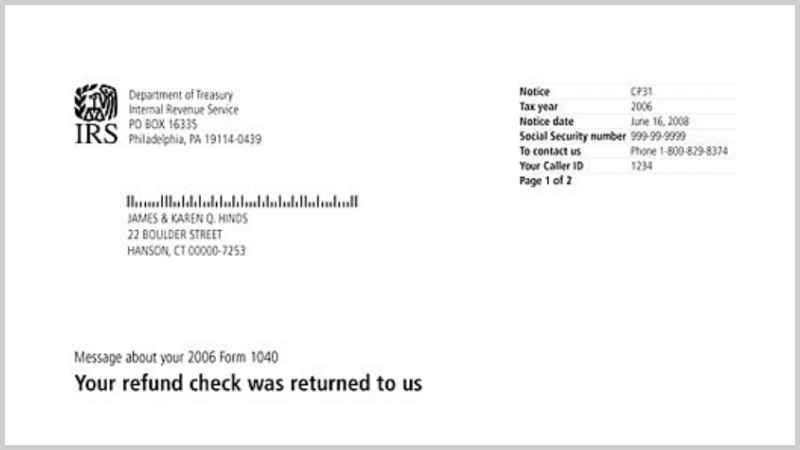

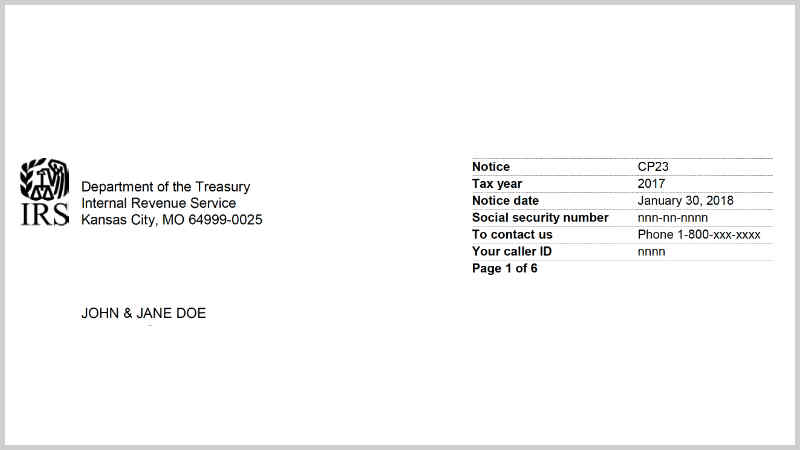

IRS CP Notices

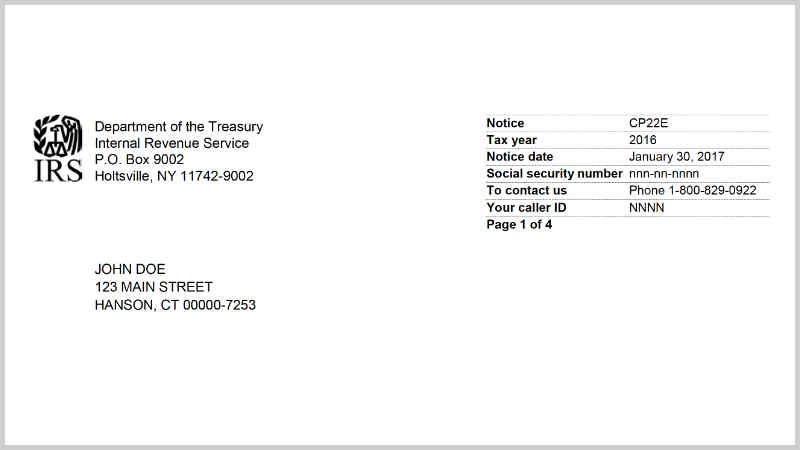

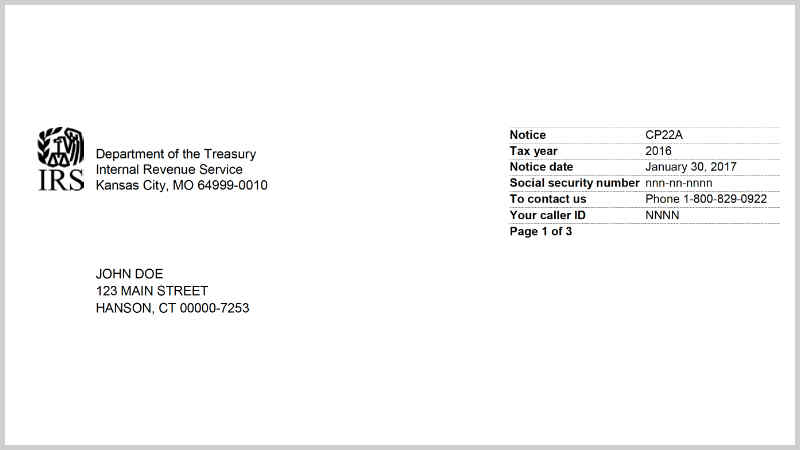

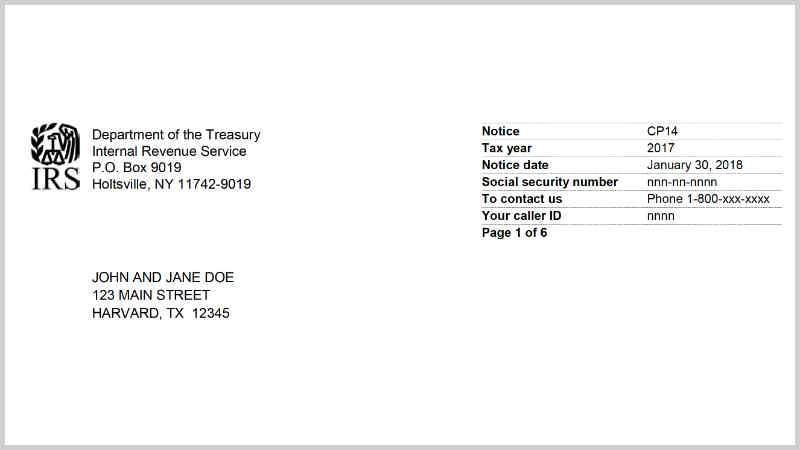

When the IRS believes that you owe back taxes, they will send you a letter (an IRS Letter). Although there are a number of letters they might send you, we offer a full list along with actual, real life copies of letters you might expect to receive.

Since we provide an explanation for each IRS letter, this is tremendously helpful to any taxpayer who receives a letter from the IRS.

If you are having problems with tax debt and/or feeling overwhelmed, we really can help. Contact us anytime with questions or to schedule a free consultation. We’ll let you know if we can help in ADVANCE of providing services.